25+ mortgage based on assets

An asset-based mortgage is a loan taken out to purchase real estate when the property being purchased is not the collateral. This way a borrower can use.

:max_bytes(150000):strip_icc()/dotdash_Final_Two_and_Twenty_Oct_2020-01-7ca86fbd38b64e59a879a71b9ad779eb.jpg)

Two And Twenty Explanation Of The Hedge Fund Fee Structure

Ad Compare the Best House Loans for March 2023.

. Web An asset-based mortgage is a loan that allows a lender to confirm approval based on the assets the borrower possesses. Web This gives them an asset-based income of 3750 per month. Lock Your Rate Today.

Find A Lender That Offers Great Service. Apply Get Pre-Approved Today. Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac.

Web 8 hours agoHeres how duration risk came back to bite Silicon Valley Bank and led to its rapid collapse. Apply Get Pre-Approved Today. Web An asset-based mortgage is a loan that uses an individuals assets instead of income during the loan approval process.

Lock In Your Rate With Award-Winning Quicken Loans. Web But not all reforms have stuck. It involves securing a mortgage debt against a valuable asset rather than.

Ad Compare the Best House Loans for March 2023. March 10 2023 925 AM PST. Web Asset-based lending is a business loan secured by collateral assets.

The asset-based loan or line of credit is secured by inventory accounts receivable. Web ASSET-BASED MORTGAGES. Web With an asset depletion mortgage lenders calculate your monthly income by dividing your total qualifying assets by 360 months.

Get Instantly Matched With Your Ideal Mortgage Lender. Web The formula for computing the eligible loan amount was based on 60 of retirement assets if youre below age 59-½ plus 70 of non-retirement assets. In 2018 under then-President Donald Trump Congress rolled back Dodd-Frank Act regulations for regional banks with under 250.

An asset-based loan or asset depletion loan is best. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Lock Your Rate Today.

SVB Financials cash crunch. These are often called asset-depletion loans and lenders qualify you based on up to 100 of your liquid asset value divided by. Get Instantly Matched With Your Ideal Mortgage Lender.

1350000 360 months 3750 monthly income. Ad Get Preapproved Compare Loans Calculate Payments - All Online. Web SVB collapse highlights 620 billion hole lurking in banks balance sheets.

A man passes a sign Silicon Valley Banks headquarters in Santa Clara. Web What is an asset-based mortgage. Compare More Than Just Rates.

The number of months used in the. Web The deposit outflow forced SVB to sell assets and take a 18 billion loss a move the bank made because we expect continued higher interest rates pressured. 1000000 350000 1350000 total assets.

Web Use SmartAssets free mortgage calculator to estimate your monthly mortgage payments including PMI homeowners insurance taxes interest and more. Web An asset-based mortgage is a bespoke form of borrowing for high net worth individuals. Web The average interest rate on a 30-year mortgage is just above 3 while for a 15-year fixed-rate mortgage its about 27 according to NerdWallet.

Home Loans Cobalt Credit Union

Ecfr 7 Cfr Part 1744 Post Loan Policies And Procedures Common To Guaranteed And Insured Telephone Loans

:max_bytes(150000):strip_icc()/DDM_INV_leaseback_final-1e87ef82359842b483272381036d3576.jpg)

Leaseback Or Sale Leaseback Definition Benefits And Examples

Sec Filing United Community Banks Inc

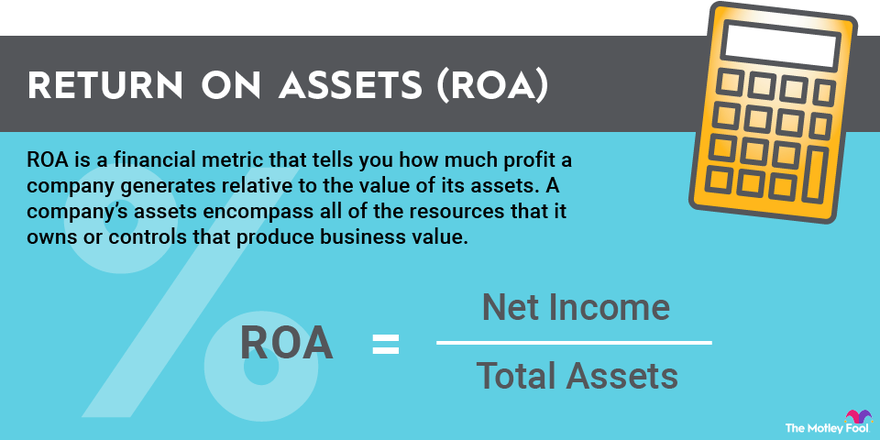

How To Calculate Return On Assets Roa The Motley Fool

The Future Of U K Nonbank Mortgage Lending And How It Will Affect Rmbs S P Global Ratings

Qualifying For Mortgages With Assets Only No Income Necessary Jvm Lending

Carlton Corporate Overview

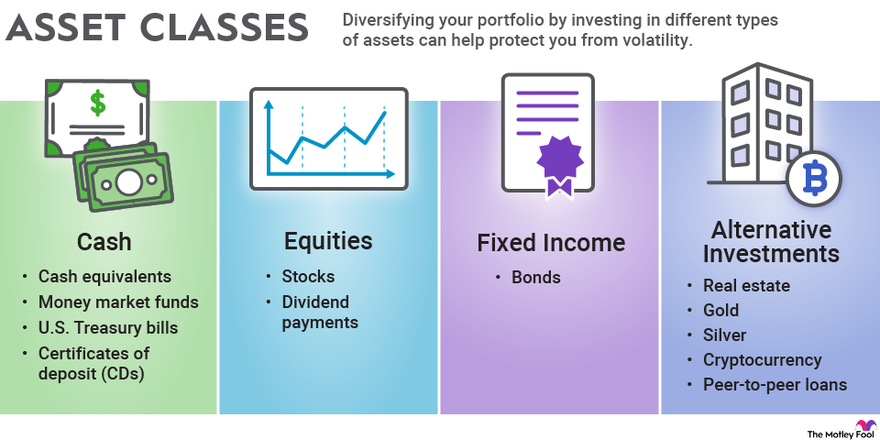

Asset Classes Explained The Motley Fool

The Role Of The Centrelink Pls In Addressing Australia S Retirement Funding Challenge Adviservoice

Rjf2021analystinvestorda

Loan X Mortgage The Simplest Way To Buy Or Refinance A Home

:max_bytes(150000):strip_icc()/Employee-Stock-Option-fffca69f497d469f9e0f6b0da712b06d.jpg)

Employee Stock Options Esos A Complete Guide

/mortgagemarvel/Down_Payment_Calc-rd12e.jpg)

Asset Based Mortgage Qualify For A Home Loan Using The Cash Flow From Your Liquid Investment Portfolio Unconventional Lending Blog

Ccf 0plukan1hm

1 Labour Market Developments The Unfolding Covid 19 Crisis Oecd Employment Outlook 2021 Navigating The Covid 19 Crisis And Recovery Oecd Ilibrary

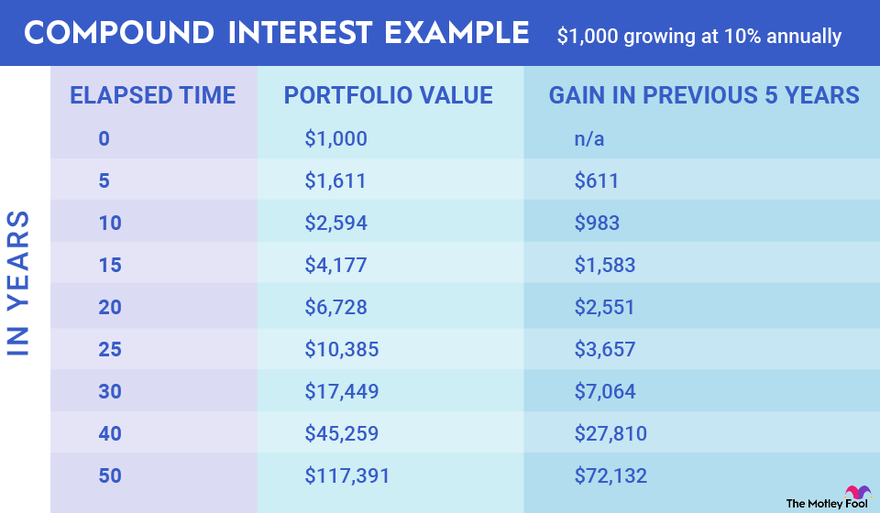

Accounts That Earn Compounding Interest The Motley Fool